Explore OpenAI’s potential initial public offering (Openai Ipo ), notable revenue growth through ChatGPT Plus, and the influence of Microsoft’s investment on its market value.

Summary: OpenAI, known for its advancements in AI and natural language processing, has not disclosed an Openai Ipo date.

The transition from a non-profit to a “capped-profit” model and Microsoft’s substantial investments, valuing the company at $27 billion, emphasize its market importance.

OpenAI’s revenue, driven mainly by ChatGPT Plus, has experienced a significant annual increase, reaching $1.6 billion.

With Microsoft holding a 49% stake and the company’s continuous technological progress, OpenAI emerges as a potential high-value Openai Ipo contender in the AI sector.

Is OpenAI Going to Openai Ipo ?

OpenAI has not provided a specific date for its anticipated initial public offering (Openai Ipo ). The company’s potential Openai Ipo has generated considerable attention within the artificial intelligence industry, mainly owing to its pioneering advancements in natural language processing (NLP) and deep learning technologies.

In the last year, OpenAI has notably expanded its influence in the AI sector, driven by the successive launches of ChatGPT Versions 3, 3.5, and the latest iteration, ChatGPT4.

These advanced text-based AI models have achieved a significant milestone, attracting 100 million users within two months of each release.

Despite the heightened public interest and technological successes, OpenAI remains an independent entity and has outlined plans for an Openai Ipo at an unspecified future date.

OpenAI Stock Valuation:

As of the present moment, OpenAI has not disclosed any plans for an initial public offering (Openai Ipo ), and consequently, there is no established stock price.

However, the company recently secured a substantial investment of $300 million, valuing its worth at $27 billion. This funding round attracted contributions from prominent venture capital firms, such as Sequoia Capital and Andreessen Horowitz.

The eventual Openai Ipo price of OpenAI will be influenced by several factors, including overall market conditions and investor interest in the AI sector during its potential public offering.

The company’s groundbreaking contributions to artificial intelligence and natural language processing are expected to play a pivotal role in generating enthusiasm among investors.

Read: W-Mop Login – A Complete GuideLines In 2024

Ownership of OpenAI:

OpenAI, originally backed by influential figures such as Elon Musk and Peter Thiel, underwent a transformation from a nonprofit to a “capped-profit” entity in 2019. This transition was notably catalyzed by a substantial $1 billion investment from Microsoft.

Presently, Microsoft holds a 49% stake in OpenAI, aligning with the combined ownership of other investors. The remaining 2% remains with the original OpenAI nonprofit foundation, ensuring governance and independence.

In 2023, Microsoft further invested $10 billion to enhance ChatGPT, potentially valuing OpenAI at $29 billion. This investment structure restricts profits for partners and facilitates wealth redistribution through the nonprofit foundation, particularly focusing on the advancement of Artificial General Intelligence (AGI).

OpenAI Revenue:

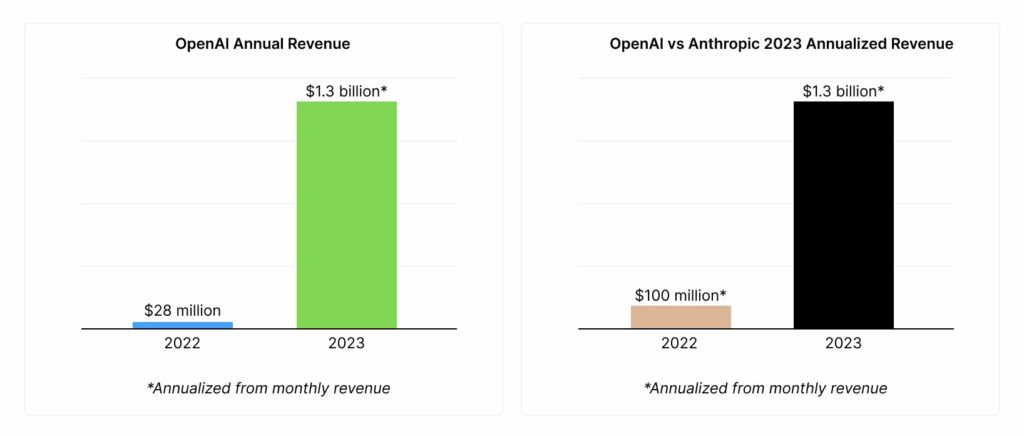

OpenAI has witnessed a rapid surge in revenue, reaching an annualized $1.6 billion, a substantial increase from $1.3 billion within a span of two months. This upswing follows the introduction of ChatGPT Plus in February 2023, signaling a shift from its prior emphasis on API-based revenue generation.

Initially forecasting $200 million in sales for 2023, the company has surpassed expectations with a revenue run-rate exceeding $1 billion in August, further climbing to $1.3 billion, and currently standing at $1.6 billion. This indicates a growth rate surpassing 20% in just two months.

End-of-year projections suggest a potential elevation in annualized recurring revenue to around $5 billion, indicating the prospect of new AI services and the development of GPT-5, as disclosed by CEO Sam Altman.

Read: What Would Cause Trailer Tail Lights Not To Work?

FAQ’s

1. Is OpenAI planning to go public with an Openai Ipo ?

OpenAI has not disclosed a specific date for an initial public offering (Openai Ipo ), but there is notable anticipation within the AI industry due to its advancements in natural language processing.

2. What has driven OpenAI’s influence in the AI sector in the past year?

OpenAI’s influence has expanded, driven by successive launches of ChatGPT Versions 3, 3.5, and ChatGPT4. These text-based AI models attracted 100 million users within two months of each release.

3. What is the current valuation of OpenAI?

OpenAI recently secured a $300 million investment, valuing the company at $27 billion. The Openai Ipo price, when disclosed, will be influenced by market conditions and investor interest in the AI sector.

4. Who are the major contributors to OpenAI’s recent funding round?

Prominent venture capital firms, including Sequoia Capital and Andreessen Horowitz, contributed to OpenAI’s recent funding round.

5. How does ownership of OpenAI currently stand?

Microsoft owns a 49% stake in OpenAI, matching the combined ownership of other investors. The remaining 2% is held by the original OpenAI nonprofit foundation, ensuring governance and independence.

6. What transformation did OpenAI undergo in 2019?

In 2019, OpenAI transitioned from a nonprofit to a “capped-profit” entity, driven by a substantial $1 billion investment from Microsoft.

7. What was Microsoft’s additional investment in OpenAI for in 2023?

In 2023, Microsoft invested an additional $10 billion to enhance ChatGPT, potentially valuing OpenAI at $29 billion. This investment focuses on advancing Artificial General Intelligence (AGI).

8. How has ChatGPT Plus impacted OpenAI’s revenue?

OpenAI’s revenue has surged to an annualized $1.6 billion, with significant growth following the introduction of ChatGPT Plus in February 2023, showcasing a shift from API-based revenue.

9. What were OpenAI’s initial sales projections for 2023?

Initially projecting $200 million in sales for 2023, OpenAI has exceeded expectations with a revenue run-rate exceeding $1 billion in August and a current standing of $1.6 billion.

10. What does the end-of-year revenue projection indicate for OpenAI?

End-of-year projections suggest a potential rise in annualized recurring revenue to approximately $5 billion, hinting at new AI services and the development of GPT-5, as revealed by CEO Sam Altman.

Bottom Line

In summary, although OpenAI has not provided a specific date for its Openai Ipo , the company’s noteworthy progress in AI, particularly with ChatGPT versions and the shift to a capped-profit model, has established its prominence in the AI industry. The substantial investment from Microsoft, coupled with OpenAI’s remarkable revenue growth and increasing influence in the sector, highlights the likelihood of a forthcoming Openai Ipo .

Also Read:

- Best Sunnyvale California Cpa – A Highly Regarded Financial Experts

- Challenges And Opportunities In Insurtech Marketing

- 6 Services Plumbing Companies Offer