Introduction to mygreenbucks+.net:

In today’s fast-paced financial landscape, managing personal finances can be challenging. mygreenbucks+.net emerges as a comprehensive platform designed to help users take control of their budgeting and financial planning.

By offering a user-friendly interface and a range of tools, mygreenbucks+.net empowers individuals to make informed financial decisions and achieve their financial goals. Whether you’re looking to save for a vacation, pay off debt, or build an emergency fund, this platform offers the resources you need to succeed.

Benefits of Using mygreenbucks+.net:

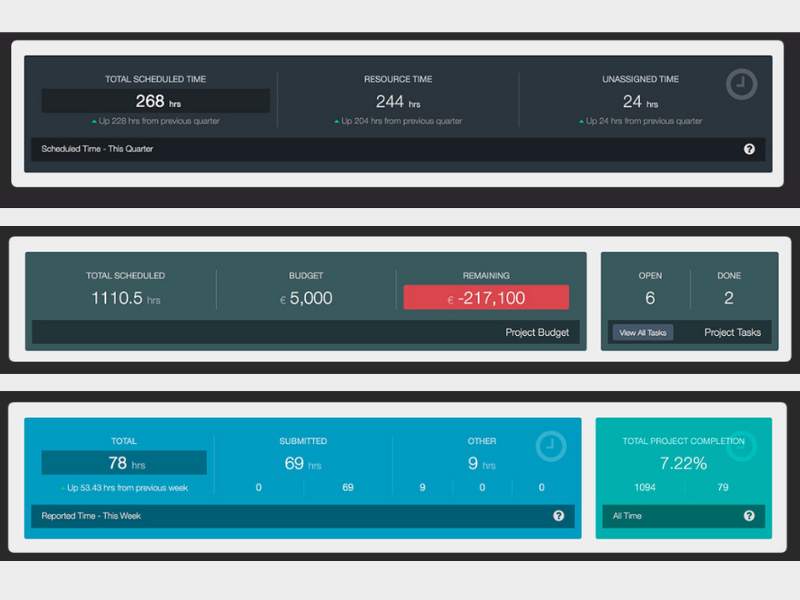

mygreenbucks+.net offers numerous benefits that set it apart from traditional budgeting methods, making it an invaluable tool for anyone looking to improve their financial management skills. One significant advantage is the intuitive dashboard, allowing users to track their income, expenses, and savings in real time.

This comprehensive view helps individuals grasp their financial situation quickly, enabling informed decisions. Instead of juggling multiple spreadsheets or apps, users can consolidate all their financial information into one user-friendly interface.

Intuitive Dashboard for Real-Time Tracking:

The intuitive dashboard simplifies the budgeting process and enhances user experience. Users can easily navigate their financial data, providing instant access to crucial metrics like total income and monthly expenses. This real-time tracking fosters awareness about spending habits and overall financial health.

Visual representations, such as graphs and charts, help users identify trends and make necessary adjustments to remain aligned with their financial goals.

Customizable Budgeting Templates:

Another standout feature of mygreenbucks+.net is its customizable budgeting templates, which allow users to tailor financial plans to suit their lifestyles and goals. Whether you’re a student managing a limited income or a family saving for a home, these templates can be adjusted to fit your specific needs.

Users can categorize expenses based on personal priorities, providing a clearer picture of their spending. This level of personalization encourages active engagement with financial plans, increasing the likelihood of sticking to budgets and achieving objectives.

Access to Educational Resources:

mygreenbucks+.net prioritizes financial literacy by offering a wealth of educational resources, including articles and videos on personal finance. These resources empower users to understand financial concepts better and apply them effectively to their budgeting strategies.

Topics range from saving techniques to debt management, catering to users at all knowledge levels. This continuous learning opportunity fosters confidence, enabling individuals to make informed decisions that positively impact their financial well-being.

Also Read: 6 Essential Oils to Make Scented Shampoo

Built-In Alerts and Reminders:

Built-in alerts and reminders enhance the user experience by keeping individuals on track with their financial commitments. These proactive notifications ensure users never miss a payment, helping them avoid late fees and credit score impacts. Users can customize alert settings to receive notifications for upcoming bills or budget milestones.

This feature promotes accountability and reduces financial stress, allowing users to focus on achieving their goals without worrying about missed deadlines.

Comprehensive Support System:

mygreenbucks+.net provides a comprehensive support system that includes community engagement. Users can connect with like-minded individuals through forums and discussion groups, sharing tips, experiences, and advice. This peer support creates camaraderie, making the budgeting process less isolating and more enjoyable.

By learning from each other’s successes and challenges, users gain new perspectives on managing their finances, fostering motivation and commitment to their financial journeys.

How to Get Started with mygreenbucks+.net:

Getting started with mygreenbucks+.net is simple and straightforward. Begin by visiting the website and signing up for an account, which typically only takes a few minutes. Once registered, you can link your bank accounts and credit cards securely to import transactions automatically.

The platform will guide you through setting up your budget by categorizing your income and expenses, allowing you to see where your money is going. With customizable features, you can adjust your budget as needed and set savings goals to monitor your progress effectively.

Success Stories: Real People, Real Results with mygreenbucks+.net:

Many users have experienced transformative results through mygreenbucks+.net. Take Sarah, for example, a young professional who struggled with overspending. After using the platform, she was able to create a realistic budget and stick to it, ultimately saving enough money for a dream vacation.

Another user, Mark, was able to pay off his credit card debt in just six months by utilizing the budgeting tools and financial insights provided by mygreenbucks+.net. These success stories showcase the platform’s potential to help individuals achieve their financial dreams through effective budgeting and planning.

Comparison to Other Budgeting Platforms:

When comparing mygreenbucks+.net to other budgeting platforms, its unique features shine. While many platforms offer basic budgeting tools, mygreenbucks+.net combines user-friendly design with extensive educational resources, making it ideal for both beginners and seasoned budgeters.

Unlike some competitors, it also emphasizes community support, allowing users to share experiences and tips. Additionally, the platform’s commitment to security ensures that users’ financial data remains safe, a critical factor for anyone considering a budgeting tool.

Also Read: 5 Common Myths About the Green Card Application Process

Cost-Effective Pricing Plans:

mygreenbucks+.net offers several cost-effective pricing plans designed to cater to various needs. Users can start with a free version that provides essential budgeting features, making it accessible for anyone looking to improve their financial situation without any upfront costs.

For those seeking advanced tools and resources, premium plans are available at competitive rates, often including features like personalized financial coaching and advanced reporting. This tiered pricing structure allows users to choose a plan that aligns with their budget and financial goals.

Real-Life Success Stories from mygreenbucks+.net Users:

The effectiveness of mygreenbucks+.net is underscored by the real-life success stories of its users. For instance, Emily, a college student, managed to save over $1,000 for her studies by leveraging the platform’s budgeting features.

Meanwhile, David, a small business owner, used mygreenbucks+.net to track his business expenses and ultimately increased his profits by identifying areas to cut costs. These stories highlight the practical impact of using mygreenbucks+.net, illustrating how it can lead to significant financial improvements in users’ lives.

FAQ’s

1. What ismygreenbucks+.net?

MyGreenBucks.net is a comprehensive platform designed to help users manage their budgeting and financial planning effectively.

2. How does the dashboard ofmygreenbucks+.net work?

The dashboard provides real-time tracking of income, expenses, and savings, helping users grasp their financial situation quickly.

3. Can I customize my budget onmygreenbucks+.net?

Yes, users can customize budgeting templates to fit their specific lifestyles and financial goals.

4. What educational resources doesmygreenbucks+.net offer?

The platform offers a wealth of articles and videos on personal finance to enhance users’ financial literacy.

5. How can I get started withmygreenbucks+.net?

Getting started is easy; simply sign up on the website, link your bank accounts, and set up your budget.

Conclusion

MyGreenBucks.net serves as a powerful tool for individuals seeking to enhance their financial management and budgeting skills. With its user-friendly dashboard, customizable templates, and educational resources, users can take charge of their finances and work toward their financial goals. The platform’s community support and success stories further reinforce its effectiveness in helping users achieve lasting financial success.

Related Post:

- Also Read: Scalp Micropigmentation: Benefits For Different Types of Hair Loss

- Also Read: The Impactful Addition of Higher Education for Your Resume: Elevate Career Prospects

- Also Read: BTC 6.0 Avage: The Next Evolution in Cryptocurrency Trading