The saga of GameStop’s (GME) stock will forever remain a hallmark in the history of modern financial markets. What began as a seemingly undervalued retail stock turned into one of the most extraordinary financial events of the 21st century. At the core of this meteoric rise lies a powerful convergence of retail investors, online platforms like FintechZoom, and social media movements.

The term FintechZoom GME stock refers to the analysis and real-time insights provided by FintechZoom on GameStop (GME) stock, which gained massive attention during the 2021 short squeeze.

In this article, we’ll explore the factors that led to GME’s rise, FintechZoom GME stock role in informing investors, and the broader implications for the financial world.

The Beginning of the GME Stock Phenomenon

In early 2021, GameStop a brick-and-mortar retailer once considered a relic of the pre-digital age became the focal point of a short squeeze that sent shockwaves across the financial markets. The short squeeze was fueled by retail investors from the online Reddit forum WallStreetBets, who spotted an opportunity to exploit the massive short interest held by hedge funds betting on the decline of GME stock.

The core of the squeeze was based on high short interest, meaning that institutional investors were heavily betting against the stock’s success. As GME’s stock price began to rise due to organized retail buying, hedge funds that had shorted the stock were forced to cover their positions by purchasing GME shares at increasingly higher prices. This self-reinforcing cycle drove GME’s stock price to unprecedented levels.

FintechZoom’s Role in the GME Saga

FintechZoom GME stock emerged as a pivotal platform during this time, providing essential tools, resources, and up-to-date analysis to retail investors. The platform’s stock screeners, financial calculators, and educational materials became crucial for traders looking to make informed decisions during volatile trading periods. In a financial world often dominated by institutional expertise, FintechZoom GME stock leveled the playing field by giving retail investors the knowledge and resources to compete in real-time.

Unlike many traditional financial platforms, FintechZoom GME stock offers an analysis that is digestible for both novice and seasoned investors. It became a central hub for those seeking to track the GME stock’s performance, especially during the frenzy that saw stock prices soar by hundreds of percentage points in mere weeks.

Understanding the Key Factors That Propelled GME Stock

The rise of GME stock was not driven by fundamental factors. Instead, it was a complex interplay of market mechanics, retail investor enthusiasm, and social media amplification.

Read Money 6x Reit Holdings: Unlocking Wealth In Real Estate Investments

1. Short Interest and the Short Squeeze

The GME short squeeze is perhaps one of the most well-documented financial maneuvers of recent times. Short sellers, primarily institutional hedge funds, had heavily shorted FintechZoom GME stock, believing that its value would decline as the company’s traditional retail business model became increasingly obsolete in the digital age.

However, the high short interest made GME an ideal target for retail investors, who coordinated a mass buying effort through platforms like Reddit’s WallStreetBets. This created a short squeeze, where short sellers were forced to buy back the stock to cover their losses, thereby pushing the price up even further.

2. Retail Investor Mobilization

What made the GME event truly remarkable was the unprecedented involvement of retail investors, primarily using platforms like Robinhood and coordinating via social media. This collective action effectively democratized the trading process, allowing retail investors to dictate terms previously controlled by large institutions.

Retail investors viewed GME not only as a financial opportunity but as a symbolic rebellion against Wall Street’s dominance. As coverage of the stock’s rise spread across social media, the FOMO (fear of missing out) effect fueled even more buying, further driving up the stock’s value.

3. Media and Social Media Influence

Media coverage and platforms like FintechZoom GME stock played a significant role in amplifying GME’s stock surge. As news outlets began reporting on the short squeeze, the stock’s price skyrocketed. At the same time, social media platforms like Reddit and Twitter became central hubs for information dissemination, allowing retail investors to strategize and act swiftly.

FintechZoom GME stock, with its real-time updates and comprehensive analysis, helped bridge the gap between institutional knowledge and retail investor action. The platform not only provided insights into the stock’s ongoing performance but also helped educate a new generation of investors about the risks and rewards of volatile stock trading.

GameStop’s Transformation: Post-Squeeze Plans and Challenges

Following the initial stock price surge, GameStop’s leadership took decisive action. The appointment of Ryan Cohen, the founder of Chewy, as chairman marked the beginning of a strategic pivot toward digital retail. GameStop began focusing on becoming a leader in e-commerce and digital gaming while also exploring new opportunities in NFTs (non-fungible tokens) and collectibles.

Despite these ambitious plans, GameStop faces significant challenges:

- Shifting Consumer Habits: With the gaming industry rapidly moving towards digital downloads and subscription-based services, GameStop’s traditional retail model is becoming increasingly obsolete.

- Financial Pressures: GameStop’s brick-and-mortar stores are struggling to remain profitable, and the company faces the daunting task of overhauling its business while managing substantial debt.

- Skeptical Investors: Many institutional investors remain cautious, questioning whether GameStop can truly transform into a viable digital business. This skepticism has contributed to the continued volatility of GME stock.

Lessons Learned from the GME Stock Saga

The GME phenomenon offers several key lessons for retail investors, financial institutions, and regulators alike:

The Power of Retail Investors

The GME short squeeze demonstrated the power of collective retail action. For the first time, a large group of small-scale investors was able to influence stock prices in a way that rivaled institutional players. This marked a significant shift in market dynamics and proved that retail investors, armed with the right tools and knowledge, could compete with hedge funds.

Volatility and Risk

While the rewards of investing in GME were astronomical for some, many retail investors who entered the stock at its peak faced substantial losses when the price inevitably fell. The GME saga underscored the risks associated with speculative trading and the importance of financial literacy.

.

The Role of Social Media in Financial Markets

Social media’s role in financial markets is now undeniable. Platforms like Reddit, Twitter, and Discord have become essential tools for retail investors to communicate, coordinate, and act. However, this also raises concerns about market manipulation and misinformation, leading regulators to call for updated rules to address these emerging risks.

The Importance of Information and Tools

Platforms like FintechZoom GME stock have leveled the playing field for retail investors by providing them with the information, tools, and analysis they need to make informed decisions. As more retail investors enter the market, the demand for such resources will only grow.

FAQs:

1. How much will GME stock be worth?

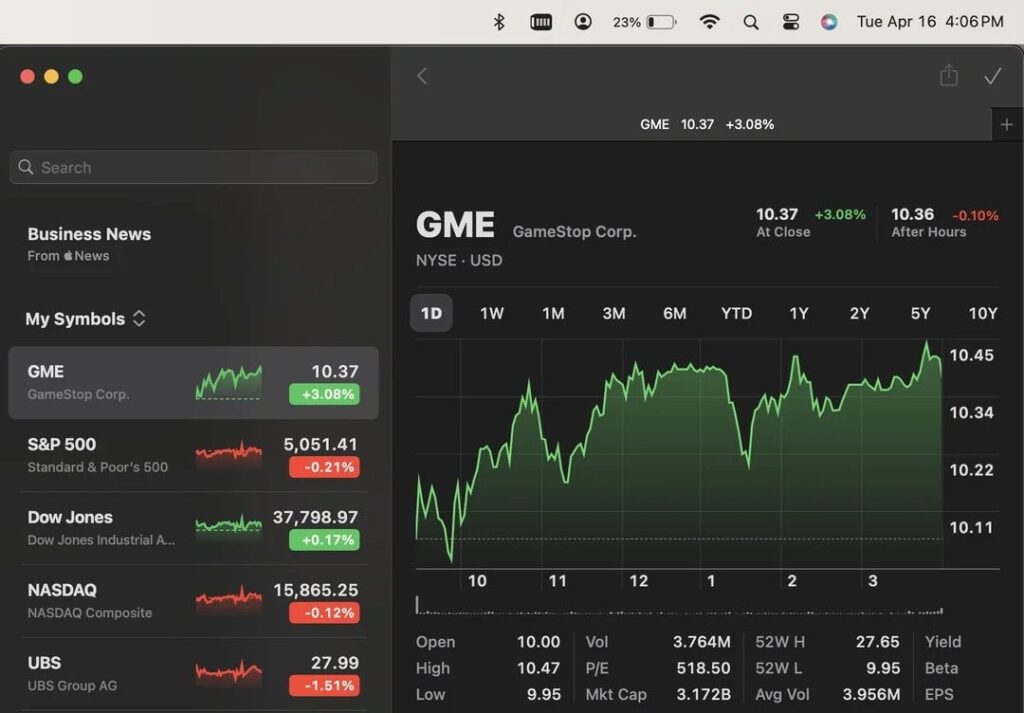

GME stock is currently forecasted to average around $13.77 in 2024, with projections varying between $9.95 and $17.59.

2. Who owns the most GME stock?

The largest shareholder of GameStop (GME) is activist investor Ryan Cohen, who holds around 9 million shares through his firm, RC Ventures.

3. Is GameStop a good stock to buy?

GameStop (GME) may present opportunities due to its potential recovery and shift toward digital retail, but its volatility and uncertain market position make it a risky investment, so careful research is essential.

4. What is the true value of GameStop stock?

GameStop (GME) is currently valued at around $19, with a market cap of approximately $8.74 billion and a high price-to-earnings ratio of 159.04, indicating investor optimism amid volatility.

5. How high will GME go?

GameStop (GME) stock is projected to reach around $36.75 by 2025 and could rise to $60.30 in 2026, with some estimates even suggesting potential values over $100 by 2027.

Conclusion:

The FintechZoom GME stock phenomenon has left an indelible mark on the financial world. It challenged traditional notions of market efficiency, empowered retail investors, and highlighted the profound influence of social media on stock prices. As GameStop continues to evolve its business model, GME remains a volatile stock, beloved by retail investors but scrutinized by institutional players and regulators alike.