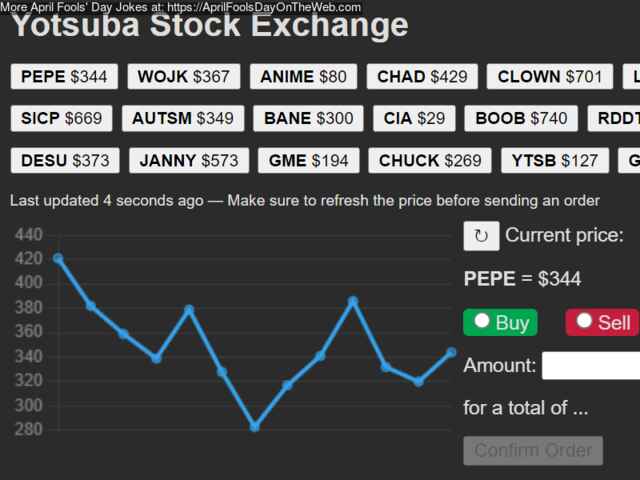

The Yotsuba Stock Exchange is a niche cryptocurrency platform that originated from internet meme culture, offering tokens like Yotsuba Koiwai (YOTSUBA). It combines decentralized finance with community-driven governance, attracting tech-savvy investors looking for innovative, low-fee trading.

From its humorous beginnings to its eventual development into a cryptocurrency and meme-driven exchange, the Yotsuba Stock Exchange offers a unique proposition for those looking to invest in the future of digital markets.

Origins of the Yotsuba Stock Exchange: From Memes to Market

The Yotsuba Stock Exchange originally surfaced as part of internet lore, particularly within the culture of imageboards like 4chan. Starting as a playful and humorous concept, it was named after Yotsuba Koiwai, a fictional character from the manga Yotsuba&! The name was fitting, considering Yotsuba’s association with quirky and light-hearted fun a stark contrast to the typically rigid world of stock exchanges.

The idea was to create a market that combined internet humor with financial speculation, giving rise to what was essentially a parody of traditional stock trading. The concept of the exchange exploded on April Fools’ Day in 2024, with multiple platforms engaging in tongue-in-cheek discussions about its role in the stock market.

The Transition to Cryptocurrency

While initially a mockery of the traditional stock market, the Yotsuba Stock Exchange eventually gained enough traction to become a functioning cryptocurrency exchange. One of the primary assets available for trading on this platform is the Yotsuba Koiwai token (YOTSUBA), a cryptocurrency linked to blockchain technology.

This token is not only steeped in meme culture but also holds real financial value for traders. Like many other cryptocurrencies, YOTSUBA tokens are traded on decentralized exchanges such as SushiSwap, where investors can buy and sell them based on market demand and supply.

What Makes the Yotsuba Stock Exchange Different?

1. Cultural Impact and Community Engagement

One of the key aspects that sets the Yotsuba Stock Exchange apart is its community-driven nature. Unlike traditional exchanges where investors focus solely on profit, Yotsuba’s user base is heavily involved in the culture surrounding the platform. The exchange has a strong presence in online communities like Discord, where members share investment tips, market updates, and memes. This blend of social interaction with financial trading creates a sense of camaraderie and collective engagement that is rarely found in more established stock exchanges.

2. Low Transaction Fees and Accessibility

One of the more pragmatic reasons for the Yotsuba Stock Exchange’s growing popularity is its low transaction fees. Unlike traditional exchanges that charge higher fees for buying and selling stocks, Yotsuba offers a more cost-effective platform, allowing investors to keep more of their profits. The low fees make it particularly appealing to small-scale investors or those who are just getting started in cryptocurrency trading.

3. Innovative Technology and Real-Time Data

The Yotsuba Stock Exchange also sets itself apart through its use of cutting-edge technology. The platform offers real-time data on market movements, enabling investors to make informed decisions quickly. This level of technological integration is crucial for traders who need to stay on top of fast-moving cryptocurrency markets, where prices can fluctuate wildly within short periods.

Read THCa Flower and Brain Health

Risks Involved in the Yotsuba Stock Exchange

Like any investment platform, the Yotsuba Stock Exchange is not without its risks. One of the primary concerns for investors is market volatility. Since the exchange is deeply rooted in internet culture and meme-based assets, it is more susceptible to sudden price changes driven by social media trends and online hype. For example, a single meme going viral could drastically increase the value of YOTSUBA tokens overnight, while negative news or a lack of interest could cause prices to plummet just as quickly

Liquidity is another issue. While the exchange is growing, some tokens listed on the platform may not have enough trading volume, making it difficult to buy or sell large quantities without affecting the price. This could pose a challenge for investors who want to exit their positions quickly.

Tips for Investors

If you’re considering investing in the Yotsuba Stock Exchange, it’s important to approach it with a clear strategy. Here are some tips to help you navigate this unique platform:

- Do Your Research: Before investing in any token, take the time to research the companies or assets behind them. Understand market trends and assess whether the investment aligns with your financial goals.

- Diversify Your Portfolio: Don’t put all your money into one token. Spread your investments across different sectors to reduce the risk of losing everything in a market downturn.

- Stay Informed: Since the Yotsuba Stock Exchange is heavily influenced by Internet culture, staying updated on social media trends and online communities is crucial. Being part of the conversation can help you anticipate market movements and make timely investment decisions.

- Use Limit Orders: Consider using limit orders to avoid buying or selling tokens at unfavorable prices. This strategy allows you to set a specific price at which you are willing to trade, giving you more control over your investments.

- Keep Emotions in Check: As with any market, it’s important not to let emotions dictate your decisions. Meme-driven assets can experience sudden price swings, so sticking to your investment plan and avoiding making impulsive choices based on short-term fluctuationsis important.

The Future of the Yotsuba Stock Exchange

Looking ahead, the Yotsuba Stock Exchange has the potential to grow into a more prominent player in the cryptocurrency world. As blockchain technology continues to evolve and become more widely adopted, niche exchanges like Yotsuba could play a key role in shaping the future of digital finance.

One of the trends likely to shape the exchange’s future is the increasing demand for sustainable and socially responsible investments. As more companies focus on green technologies and ethical business practices, the Yotsuba Stock Exchange could see an influx of new listings from firms committed to these causes, attracting environmentally conscious investors.

FAQs:

1. What is the Kose stock exchange?

The Korea Stock Exchange is now part of the larger Korea Exchange (KRX). Its electronic trading platform, KOSDAQ, is similar to the U.S. Nasdaq, while the KOSPI index tracks the overall health of the exchange, much like the S&P 500.

2. What is the main Japan stock exchange?

The Nikkei 225 is the primary index for the Tokyo Stock Exchange, representing the performance of 225 top companies in Japan.

3. How to invest in Japanese stocks from us?

Platforms like Interactive Brokers and Schwab offer direct access to Japanese stocks. Alternatively, you can invest in Japan-focused mutual funds or ETFs that track indices like the Nikkei 225 and TOPIX for broader market exposure.

4. What is the largest stock exchange in Japan?

The Tokyo Stock Exchange (TSE), founded in 1878, is Japan’s largest stock exchange. It was suspended between 1945 and 1949 due to Japan’s involvement in World War II but later resumed operations.

5. How to invest in KRX?

To trade on the KRX, investors must open an account with a licensed securities company that has KRX Membership. Orders are submitted through these member firms, which serve as agents in the market.

Conclusion:

The Yotsuba Stock Exchange is a fascinating blend of internet culture and cryptocurrency innovation. What started as a humorous nod to meme subcultures has evolved into a legitimate platform that offers both entertainment and financial opportunities for investors. While it is not without its risks, the Yotsuba Stock Exchange provides a unique investment experience for those willing to embrace its unconventional charm.