Investing can feel overwhelming due, to the options and strategies. Nevertheless, passive investing offers an efficient approach. This method enables your funds to grow with hands-on management.

In this piece, we will delve into the perks of investing. Shed light on popular passive investment choices, such as the renowned SPY stock.

Grasping Passive Investing

To appreciate the benefits of investing it’s crucial to comprehend its essence and how it differs from other investment tactics. Passive investing is a strategy that seeks to maximize returns by reducing trading. In trying to outperform the market passive investors strive to match market returns. Typically this is achieved through investments, in index funds or exchange-traded funds (ETFs) that mirror indices.

Definition of Passive Investing

Passive investing entails placing your money into investment instruments that mimic the performance of a market index. Unlike investing, where fund managers frequently trade securities to beat the market passive investing focuses on long-term growth by maintaining a portfolio that emulates the market trends. This hands-off approach reduces the need, for supervision and trading making it an appealing choice for individuals who value simplicity and effectiveness.

How Passive Investing Differs from Active Investing

The difference between active investing lies in their goals and management approaches. Active investing entails market monitoring and executing trades to capitalize on short-term price fluctuations and inefficiencies. This method typically involves fees. Increased risk stemming from frequent trading. In contrast, passive investing seeks to match the market’s return with expenses and reduced risk. By holding investments that mirror a market index passive investors enjoy the market growth without requiring adjustments.

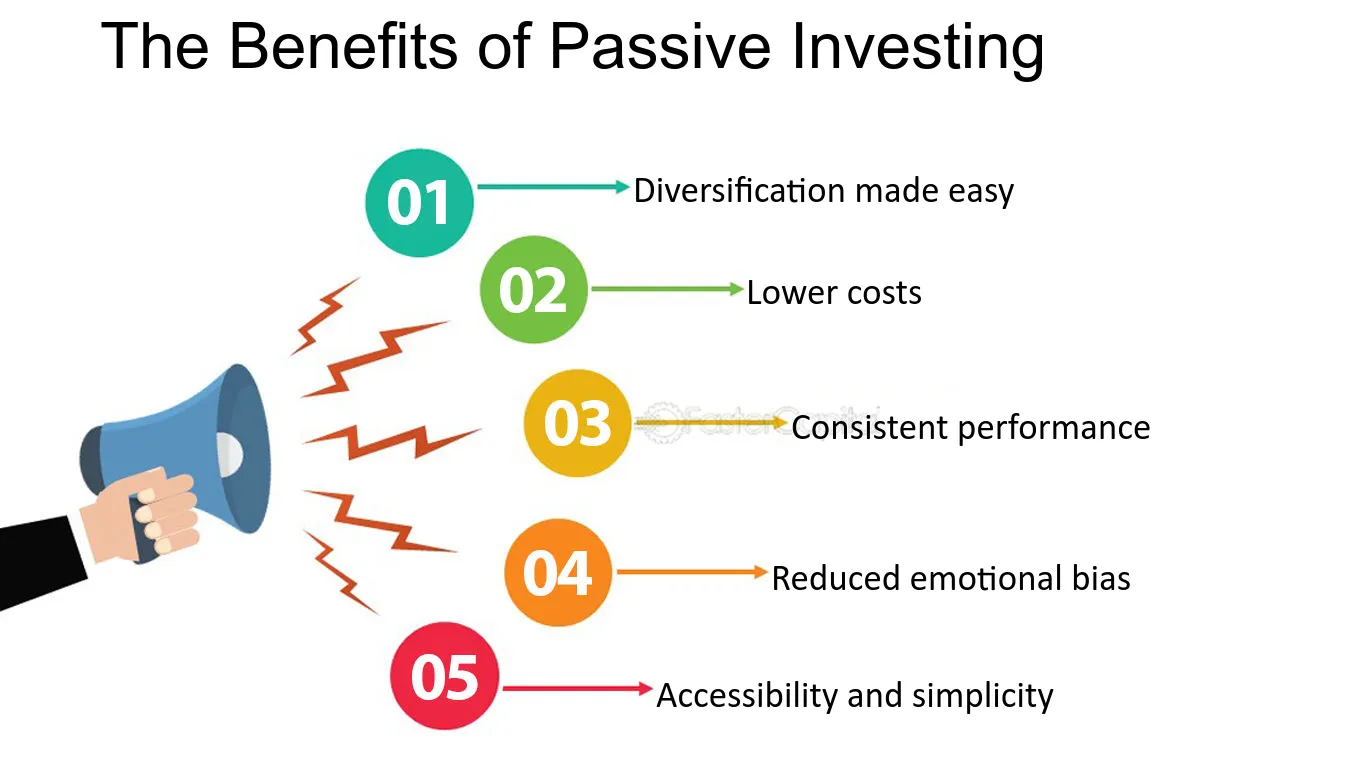

Key Advantages of Passive Investing

Choosing investment strategies offers benefits that attract many investors. These advantages encompass expenses, diversification, and steady performance.

Reduced Expenses

A key advantage of investing is its cost-effectiveness. Passive funds generally feature expense ratios in comparison, to managed funds. This is because passive funds demand supervision and fewer transactions, resulting in decreased fees. Over time these reduced costs can significantly impact your investment returns. By minimizing fees more of your investment profits remain intact enabling your portfolio to grow

Diversification

Diversification is an advantage of investing. By spreading your investments across a range of assets you can lower the risk associated with securities. For example, investing in an ETF that follows an index can give you exposure, to hundreds or even thousands of stocks. This diversification helps safeguard your portfolio from the ups and downs of investments. When one asset underperforms its impact is softened by the positive performance of assets within the fund.

Consistent Performance

Passive investments aim to mirror the performance of a market index. Historically broad market indices have shown returns over time. By tracking these indices passive investments offer a way to achieve market-level performance. This consistency can be especially attractive to investors seeking growth. While active investors may face fluctuations due, to timing and stock selection passive investors benefit from the trend of the market.

How Passive Investing Helps Your Money Grow

Understanding how passive investing works is crucial. Realizing how it enables your money to increase is equally important. Passive investing requires minimal time commitment reduces stress and leverages the power of compounding returns.

Minimal Time Commitment

One of the advantages of investing is the minimal time commitment it requires. With a “set it and forget it” strategy you can invest your money. Let it grow without the need, for supervision. This allows you to dedicate time to pursuits and reduces the stress associated with making trading decisions. By creating a diversified portfolio of investments you can concentrate on achieving long term objectives without having to analyze the market daily or engage in active trading.

Reduced Emotional Stress

Another benefit of investing is its ability to alleviate stress related to investing. Because you are not consistently striving to outperform the market there is pressure to react hastily to short-term market fluctuations. Adopting a long-term outlook can help you remain focused on your aims and prevent decision-making. While active investors may experience anxiety due to market volatility passive investors benefit from an approach that lessens the impact of temporary market swings.

Compounding Returns

Compounding returns represent another advantage of investing. By reinvesting dividends and allowing your investments to grow over time you can harness the power of compounding. This implies that your investment earnings generate earnings resulting in growth, over an extended period.Starting your investment journey early allows your money to grow through compounding leading to growth when you reach your milestones.

Popular Passive Investment Options

There are investment options that can help you create a robust and diversified portfolio. Each of these choices comes with advantages. Plays a crucial role in a passive investment approach.

SPY Stock (SPDR S&P 500 ETF)

The SPY stock, also known as the SPDR S&P 500 ETF stands out as an investment choice. This ETF aims to replicate the performance of the S&P 500 index offering exposure to 500 U.S. companies across sectors. With diversification, a low expense ratio, and high liquidity SPY ETF has demonstrated performance and stability making it a dependable option, for passive investors. Investing in SPY stock enables you to benefit from the growth of leading U.S. Companies while spreading risk across industries.

Vanguard Total Stock Market ETF (VTI)

Another outstanding option for investors is the Vanguard Total Stock Market ETF (VTI). VTI provides coverage of the U.S. Stock market encompassing small, mid, and large-cap stocks. This broad scope makes it an excellent choice for those seeking diversification, across the market. When comparing SPY stock and VTI VTI offers a selection of companies leading to increased diversification. Investing in VTI allows you to tap into sectors of the U.S. Economy strengthening the resilience of your investment portfolio.

iShares Core U.S. Aggregate Bond ETF (AGG)

For individuals looking for fixed-income opportunities, the iShares Core U.S. Aggregate Bond ETF (AGG) is a choice. AGG mirrors the performance of the U.S. investment-grade bond market encompassing government bonds, corporate bonds and mortgage-backed securities. Integrating AGG into your investment strategy can help stabilize your portfolio by offsetting equity market volatility and generating an income through interest payments.

Vanguard Total International Stock ETF (VXUS)

The Vanguard Total International Stock ETF (VXUS) provides exposure, to markets outside the U.S. By investing in VXUS you can expand your investments beyond borders and access developed as well as emerging markets worldwide. Diversifying internationally with VXUS not only lowers risk but also presents avenues for growth. Including VXUS, in your portfolio ensures that your investments are not solely tied to the U.S. spreading them across an array of assets.

Getting Started with Passive Investing

Embarking on an investing journey necessitates planning and thoughtful deliberation. To create an investment portfolio it’s crucial to evaluate your financial objectives and how much risk you are comfortable, with choose the appropriate investment opportunities and effectively oversee your portfolio.

Assessing Your Financial Goals and Risk Tolerance

Before diving into investments it’s key to understand your aspirations and willingness to take risks. Define your investment goals and risk appetite to determine the mix of investments for your situation. Consider factors like your investment timeline, financial targets, and comfort level with market changes.

Selecting the Right Passive Investment Options

Opting for investment options involves thorough research and comparison. Seek funds with fees, broad market exposure, and a track record of performance. Utilize research tools to make informed choices. Compare ETFs and index funds to find ones that align with your objectives and investment approach.

Choosing the Right Passive Investment Options

Creating a rounded portfolio with investments requires thoughtful planning. Evaluate your asset allocation. Choose ETFs that complement your investment strategy. Regularly. Rebalance your portfolio to keep it in line, with your goals and risk tolerance. Monitoring performance regularly and making adjustments can enhance the outcomes of your investments. Make sure you keep up with the market trends and changes to ensure that your investment portfolio aligns, with your long-term goals.

In summary

Passive investing comes with advantages such as expenses, diversification, consistent returns, and minimal time commitment. Known options, like SPY stocks and other ETFs, can help you establish an investment base and allow your funds to work for you. By grasping the benefits and following an approach you can attain lasting progress and security. Begin constructing your investment portfolio today to experience the peace of mind that comes from watching your money grow effortlessly.