In this comprehensive guide, we will break down how to calculate your in-hand salary, the components of a 4.5 LPA salary, and strategies for managing your finances efficiently.

1. What Does 4.5 LPA Salary Mean?

A salary of 4.5 LPA means your total annual salary package amounts to ₹4,50,000 before deductions. However, this is not the amount you’ll take home. The gross salary is made up of various components such as basic pay, allowances, bonuses, and other benefits. To calculate your in-hand salary, you need to account for deductions like Provident Fund (PF), Professional Tax (PT), and Income Tax, which can significantly reduce your take-home pay.

2. Gross Salary vs. Net Salary:

Before diving into the breakdown, it’s important to differentiate between Gross Salary and Net Salary (In-Hand Salary):

- Gross Salary: The total salary package provided by the employer, which includes your basic pay, allowances, bonuses, and other benefits.

- Net Salary (In-Hand Salary): The amount that you actually receive after all deductions have been made, including taxes and provident fund contributions.

It’s important to note that Net Salary is what you have available for your day-to-day expenses, savings, and investments.

3. How to Calculate In-Hand Salary from 4.5 LPA?

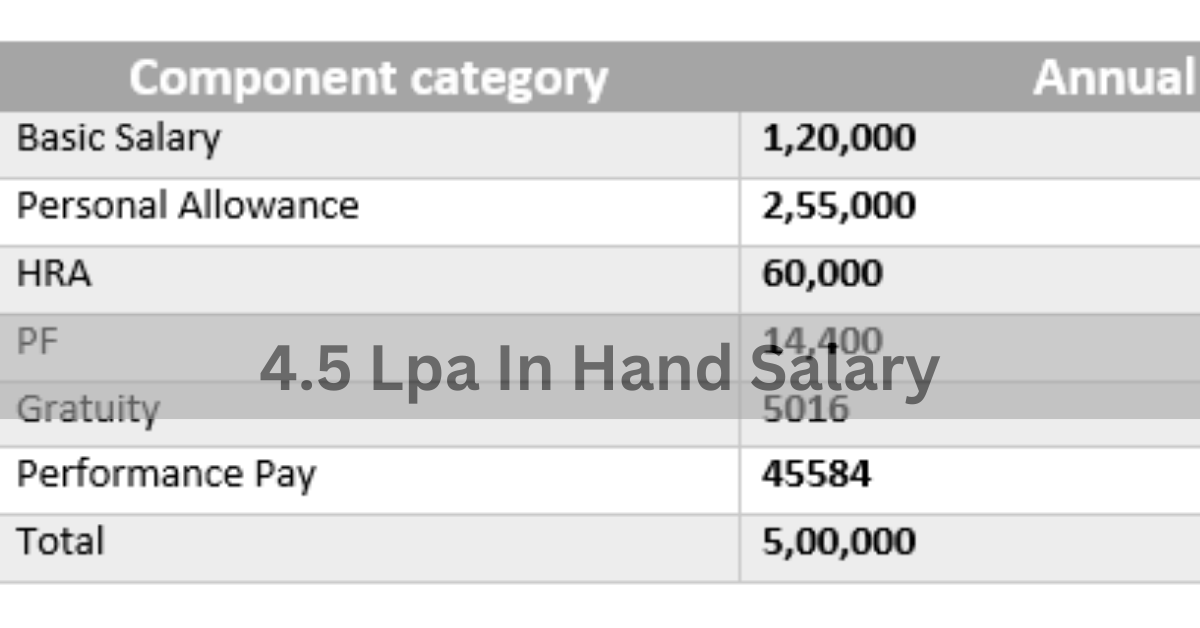

To estimate your in-hand salary, let’s break down a typical salary package of ₹4.5 LPA into its components and apply standard deductions. Please note that the following example uses generic assumptions. Your actual salary structure and deductions may vary based on company policies, tax slabs, and other factors.

Example Breakdown of a 4.5 LPA Salary:

- Basic Salary: The basic salary generally forms the bulk of your salary package, typically accounting for around 40% to 50% of the gross salary.

- Basic Salary for 4.5 LPA: 40% of ₹4.5 LPA = ₹1,80,000 per year (₹15,000 per month).

- House Rent Allowance (HRA): This allowance is designed to cover housing expenses. It usually ranges between 40% to 50% of the basic salary.

- HRA for 4.5 LPA: 50% of ₹1,80,000 = ₹90,000 per year (₹7,500 per month).

- Note: HRA may be partially tax-exempt, depending on whether you live in a rented house and the city you live in.

- Dearness Allowance (DA): This is typically added to the basic salary to offset the impact of inflation. It’s around 10% of the basic pay in most cases.

- DA for 4.5 LPA: 10% of ₹1,80,000 = ₹18,000 per year (₹1,500 per month).

- Special Allowance: Companies may provide a special allowance to cover other expenses such as transportation, meals, or medical costs.

- Special Allowance for 4.5 LPA: ₹1,62,000 per year (₹13,500 per month).

Thus, the Gross Salary per month would be:

- Basic Salary + HRA + DA + Special Allowance = ₹15,000 + ₹7,500 + ₹1,500 + ₹13,500 = ₹37,500 per month.

4. Deductions from Your 4.5 LPA Salary

Once the gross salary is determined, deductions are applied to arrive at your in-hand salary. These deductions typically include:

1. Provident Fund (PF):

A statutory deduction where both the employee and employer contribute towards the retirement savings of the employee. Typically, 12% of your basic salary is contributed to the Employee Provident Fund (EPF).

- PF Deduction for 4.5 LPA: 12% of ₹15,000 = ₹1,800 per month.

- The employer also contributes the same amount to your PF, though this is not deducted from your in-hand salary.

2. Professional Tax (PT):

Professional Tax is a tax levied by certain state governments in India. The amount varies depending on your salary and the state in which you work.

- Professional Tax for 4.5 LPA: ₹200-₹300 per month depending on your state of residence.

3. Income Tax:

Income tax is based on the annual taxable income, which is calculated after deductions like tax-saving investments (PPF, EPF, etc.). Assuming minimal exemptions and tax-saving investments:

- Income Tax Deduction for 4.5 LPA: Assuming a simple tax scenario, income tax could be ₹1,500 per month.

5. Calculating Your Net (In-Hand) Salary:

Gross Monthly Salary:

- ₹37,500 (from basic salary, HRA, DA, and allowances)

Total Deductions:

- PF: ₹1,800

- Professional Tax: ₹250

- Income Tax: ₹1,500

Total Deductions = ₹1,800 + ₹250 + ₹1,500 = ₹3,550

Net (In-Hand) Salary:

In-Hand Salary = ₹37,500 – ₹3,550 = ₹33,950

So, on a 4.5 LPA package, your approximate monthly in-hand salary would be around ₹33,950.

6. Cost of Living Considerations:

The cost of living plays a crucial role in how far your salary will stretch. While ₹33,950 may suffice for a comfortable lifestyle in smaller cities or towns, living in major metropolitan areas (Mumbai, Delhi, Bengaluru) might require careful budgeting due to higher living costs, including:

- Housing Costs: Rent can be the most significant expense, especially in cities like Mumbai and Delhi.

- Transport: Travel costs can add up, especially if you’re commuting long distances.

- Food and Utilities: Groceries, bills, and dining out can take a portion of your salary.

It’s important to adjust your monthly budget based on where you live to avoid any financial stress.

7. Tax Planning and Savings:

With an annual salary of ₹4.5 LPA, tax-saving strategies can help you reduce your taxable income and increase your in-hand salary. Here are a few ways to manage your taxes better:

- Section 80C: Use this section to claim deductions of up to ₹1.5 lakh on investments in instruments like PPF, ELSS, or Life Insurance Premiums.

- HRA Exemption: If you’re living in rented accommodation, you can claim HRA exemptions, reducing your tax liability.

- Health Insurance (Section 80D): Deduct premiums paid for health insurance policies under this section.

By optimizing your tax-saving strategies, you can reduce your tax burden and increase your in-hand earnings.

8. Is a 4.5 LPA Salary Enough?

Whether a 4.5 LPA salary is sufficient depends on your lifestyle, spending habits, and location. Here’s a quick overview:

- For a Single Person in Tier-2 Cities: A 4.5 LPA salary should provide a comfortable living, with enough left for savings and investments.

- For a Family in Tier-1 Cities: Managing a family in cities like Mumbai or Delhi may require more careful budgeting, especially if you’re paying high rent or have additional dependents.

9. How to Manage Your Finances on a 4.5 LPA Salary?

Effective money management is key to making your salary stretch further. Here are some tips to manage your 4.5 LPA salary efficiently:

- Create a Budget: Set a budget to track income and expenses, ensuring that you save and invest regularly.

- Start Saving Early: Even with a modest salary, starting an emergency fund and saving for long-term goals (retirement, buying a house) is important.

- Invest Wisely: Look into low-risk investments such as PPF or fixed deposits, or consider equity-based investments for higher returns in the long run.

Conclusion

A 4.5 LPA salary provides a solid foundation for financial stability, but managing your money wisely is essential for long-term financial security. By understanding your salary components, planning for taxes, and following prudent financial practices, you can maximize your in-hand earnings and achieve your financial goals. Whether you’re living in a big city or a smaller town, having a clear budget and saving for future expenses will ensure you make the most of your 4.5 LPA salary.